Commercial & Residential

Mortgage Locations

What is a Mortgage Location?

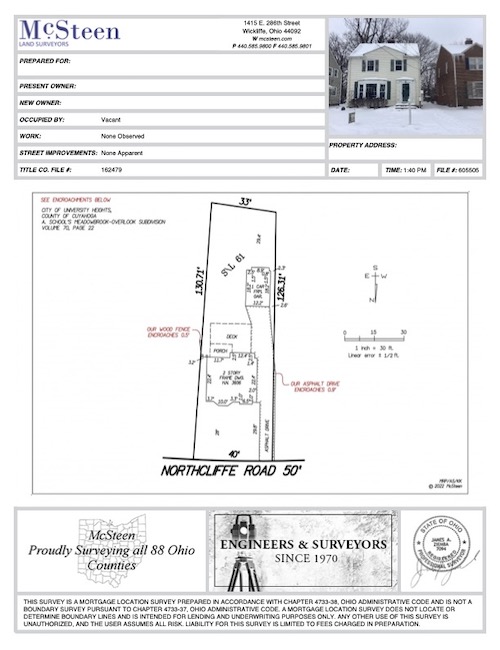

Ordered by a lender or title insurer, a Mortgage Location includes field measurement and preparation of a plat for both residential and commercial mortgage loan and title insurance purposes. This product is intended to provide proof that improvements are actually located on the property as described in the legal description and that are being transferred in the deed.

Boundary lines are not determined, and therefore this product is not intended for the use of the buyer in making purchase decisions, property improvements, or defending boundary line disputes. For these matters, the property owner will want to request a boundary survey.

Learn more about our mortgage locations and find out how to order today!

Why You Need a Mortgage Location

A Mortgage Location, also known as a Mortgage Location Survey or MLS in some states, serves a fundamental role in real estate by validating that the physical aspects of a property align precisely with the legal descriptions in the deed. Here’s why you need one:

- Proof of Property Legitimacy: MLS provides concrete evidence that the improvements on a property match the legal documentation, ensuring a legitimate and compliant property transfer.

- Smooth Property Transfers: Especially crucial in mortgage loans and title insurance, a mortgage location offers a detailed overview of property improvements, facilitating accurate and seamless transitions during property transfers.

- Understanding Limitations: While a mortgage location doesn’t determine precise boundary lines, it serves as a vital document for lenders and insurers, setting clear expectations for property owners.

- Informed Decision-Making: A mortgage location empowers property owners by providing essential insights, and influencing decisions related to property enhancements, renovations, or future transactions.

When and Why to Request a Boundary Survey

While a Mortgage Location serves its specific purpose, property owners involved in purchase decisions, property improvements, or boundary disputes require a more comprehensive solution. This is where the distinction lies – understanding when to transition from a Mortgage Location to a Boundary Survey empowers property owners to make informed choices.

Learn more about Boundary Surveys >

Benefits of a Mortgage Location from McSteen

- We are celebrating over 50 years as a family-owned business & experience is key!

- We offer a quick Turnaround Time and can meet almost any requested deadline … just ask!

- There is NO Cancellation Fee

- We are a qualified Qualia Vendor

Commercial MLS

A Commercial MLS is a low cost alternative to an ALTA. Table A and Schedule B items can be added, and each job is individually quoted.

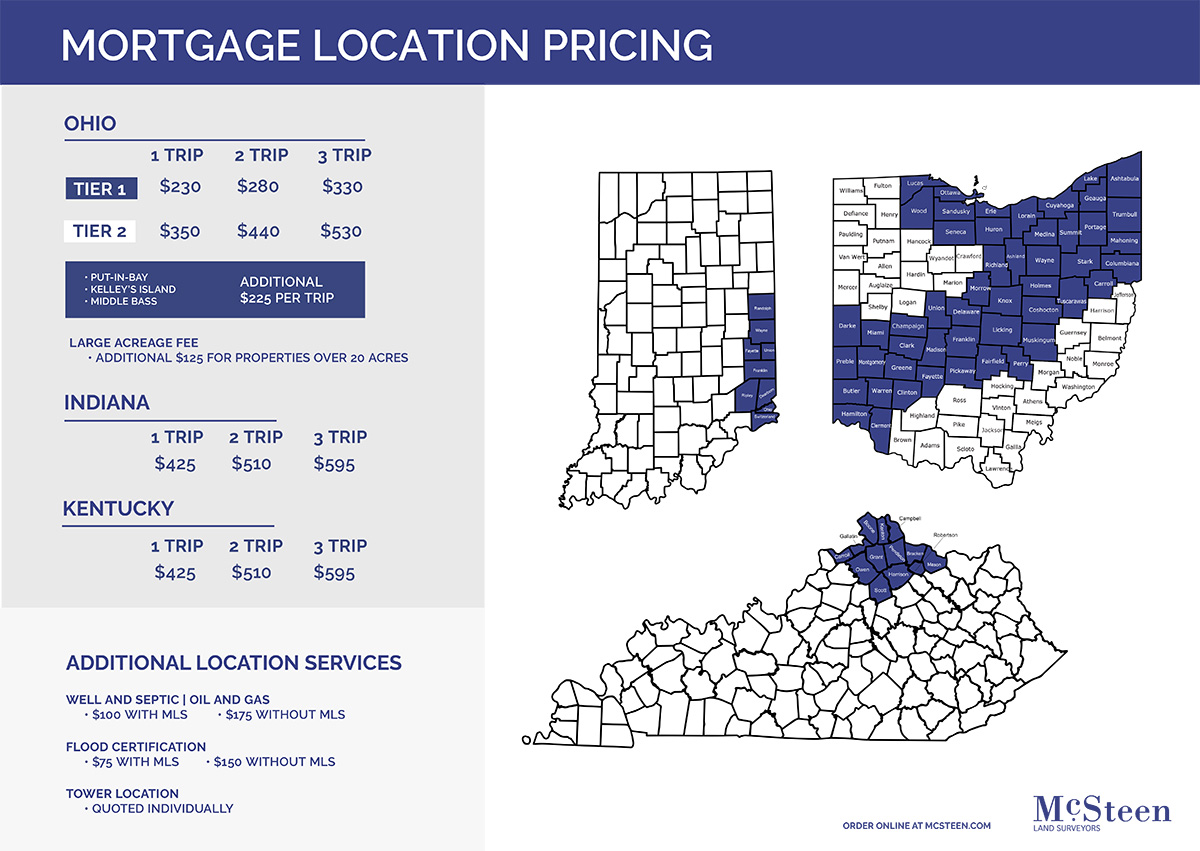

Residential MLS

View our service area and pricing and place your order online or via email/fax with our downloadable order forms.